Make benefits and equity clear to employees

Journey helps explain total compensation — like stock options, 401(k), health plans, and more — so employees stay longer and HR saves time.

Set up in minutes. Start seeing results day one.

Built for HR, loved by employees

Make benefits and equity clear to employees

Journey helps explain total compensation — like stock options, 401(k), health plans, and more — so employees stay longer and HR saves time.

Set up and use in minutes. No IT or HR team required.

Supporting fast-growing companies

Journey saves you 500+ hours of HR time every year.

500 Hours

Less time explaining benefits and equity.

More time building your company.

No more explaining vesting schedules, ISOs, FSAs, or health plan choices on repeat. That’s time back to hire better, build culture, and scale.

Save $2,000 Per Employee Yearly

Smarter health plan choices. Better 401(k) participation. Real savings for your business and your team.

30% Better Retention

People who understand equity stay 30% longer. Clear comp doubles offer acceptance rates. Win and retain talent without matching big tech salaries.

Turn equity and benefits confusion into a competitive advantage.

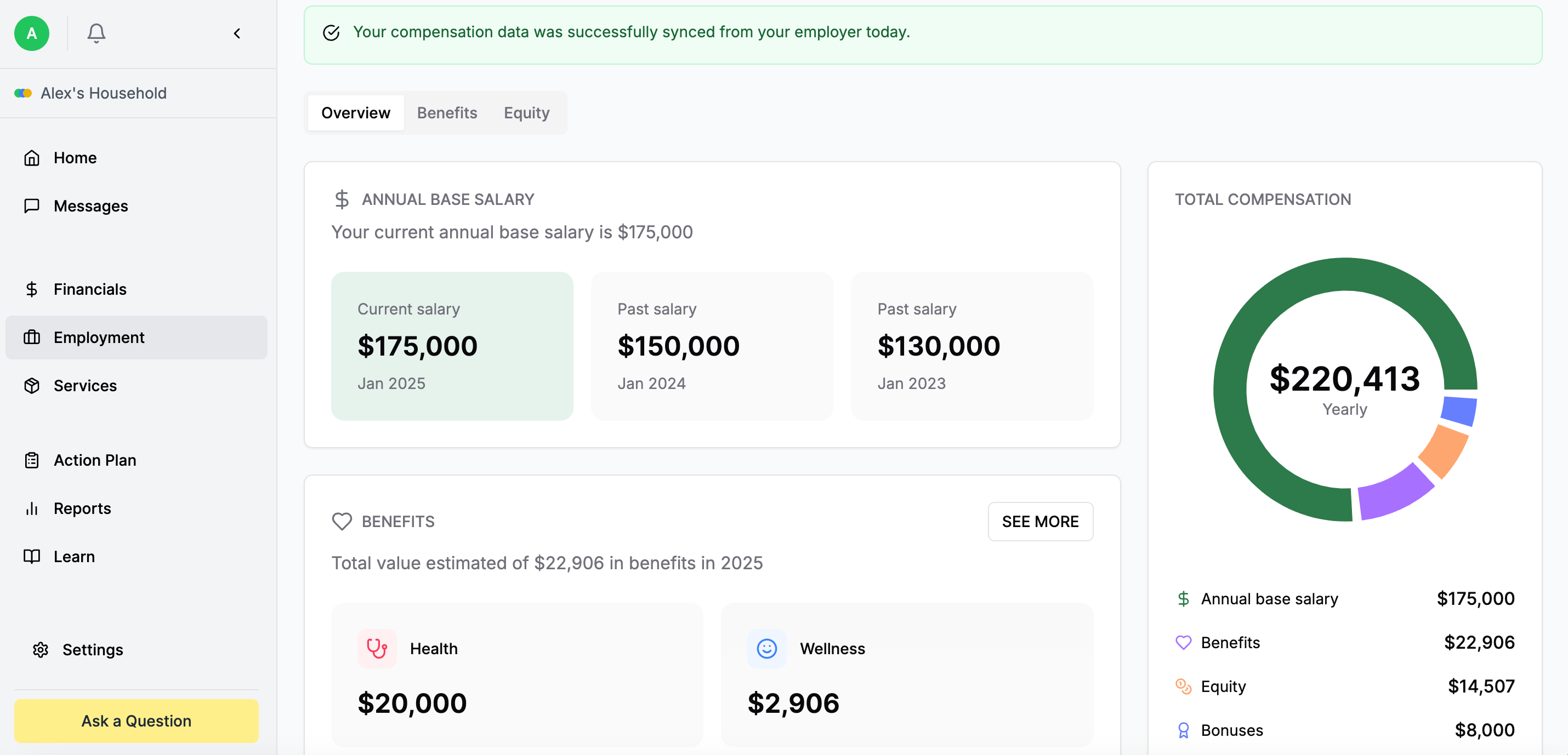

Journey gives you compensation clarity that builds trust and drives retention. Your existing HRIS data becomes personalized insights in a beautiful dashboard — synced in real-time across your team. No more scattered PDFs or repetitive questions.

< 5 minutes to launch

Plug into Gusto, ADP, Justworks — or just upload a spreadsheet. We handle the heavy lifting.

Upload docs, we do the rest

Drop in your benefits PDFs or SPDs. Journey auto-generates clear summaries for every employee.

One dashboard for everything

Employees see salary, equity, and benefits in one place — from health plans to vesting schedules.

Always up to date, everywhere

Update once — Journey instantly syncs changes across the admin portal and employee dashboards.

Built for lean HR & fast-moving teams

Whether you’re solo HR or a founder-operator, save hours of explanation and boost employee engagement.

Attract and retain top talent

Turn confusing benefits into a competitive edge. Clear compensation builds loyalty and trust.

Less confusion, more value

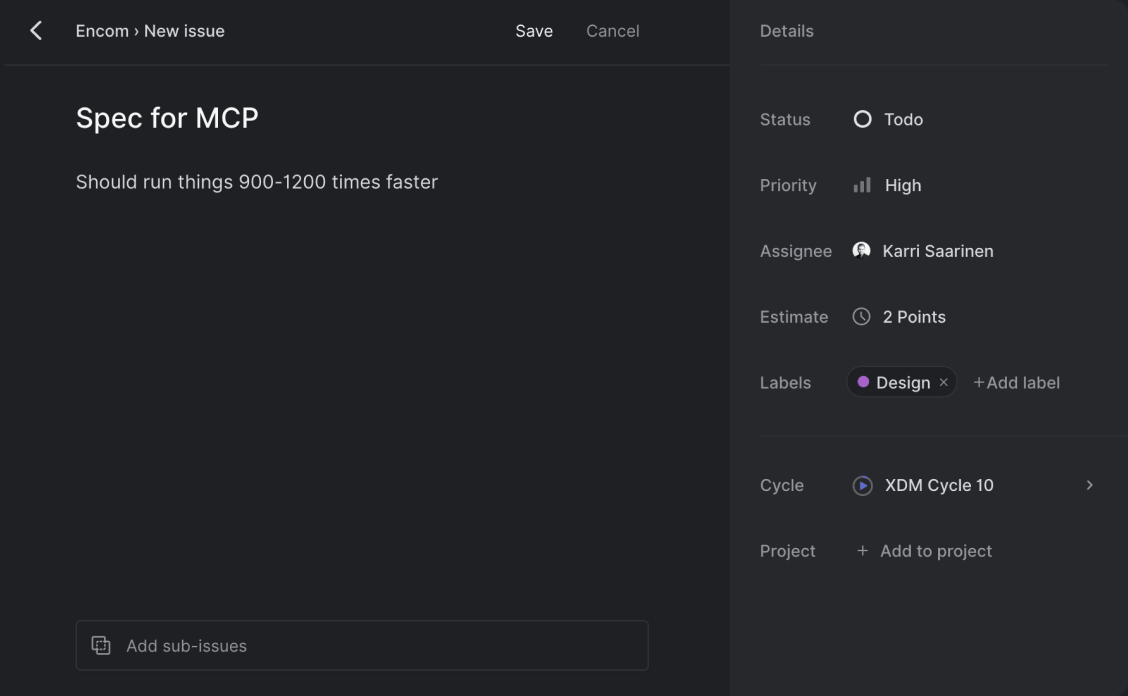

- Fast and easy setup. Connect Gusto, Rippling, Justworks, or upload a spreadsheet. No complex setup.

- Automated plan summaries. Drop in your benefits docs or SPDs. Journey extracts key details and generates clean, employee-facing summaries.

- Personalized dashboards. Each employee sees their salary, equity, benefits, and perks clearly.

A tool employees actually use.

Employees don’t want another portal — they want to know what they’re getting, when it matters. Journey gives each employee a personalized view of their salary, equity, and benefits — clear, actionable, and always up to date. No PDFs. No intranet logins. No HR back-and-forth. Just clarity.

All-in-one view

Salary, equity, benefits, and perks, in one, unified experience — not buried across multiple platforms.

Explained simply

Journey explains grants, deductibles, plan options, and confusing jargon and long benefits PDFs in plain language.

Always up to date

Changes sync automatically from your HRIS. Easily add mid-year perks. Update once, reflects everywhere instantly.

We help employers communicate and optimize total compensation—especially benefits and equity—so employees understand it and put it to work. Publish plain-English guides from your HRIS and plan docs, auto-sync updates, and send right-time nudges for open enrollment, vesting, and plan changes. Result: higher engagement, better retention, fewer HR tickets.

Result: Less HR load, better benefits utilization, and people stay longer.

Engagement signals

See what lands. Fix what doesn’t. Understand which topics employees use most and where they drop off—equity, 401(k), HMO vs PPO—so you can step in with clarity.

Optimization insights

Spot gaps before they cost you. Find missed 401(k) matches, underused HSAs/FSAs, or equity confusion—and resolve them with targeted actions.

Targeted nudges & campaigns

Reach the right people at the right time. Send reminders for open enrollment, vesting events, or underused benefits. Track open, click, and completion—no vendor tickets.

Auto-sync, always current

Publish once. Guides update everywhere. Connect your current HRIS/payroll (like Gusto, ADP, Justworks) or upload CSV. Plan changes and mid-year perks update employee guides automatically.

Admin control center

You’re not just watching—you’re steering. Access your analytics directly, update docs, push explainers, and deploy content across the platform, without waiting on a vendor or quarterly reports from a CSM.

From compensation to wealth

We help employees understand their total compensation and put it to work for their personal finances—investing, retirement, taxes, and estate—based on their situation and goals. One place to see salary, equity, and benefits in plain English, with right-time nudges and one-tap CFP® access.

Result: Higher engagement, better benefits and equity decisions, less HR back-and-forth.

Total comp, explained

ISOs/RSUs, deductibles, 401(k). Clear answers for their total compensation package.

Right-time nudges

Open enrollment, vesting, tax deadlines, life events—surfaced before they hit.

Talk to a CFP®

One tap to an advisor already briefed on your company plans and your financial situation.

Plan to build wealth

Guidance across investing, retirement, tax & estate—prioritized for personal goals.

For founders, HR, and finance—so employees finally understand and maximize their compensation.

Or: One platform that makes compensation clear, saves time, cuts costs, and boosts retention.

Founders

Close offers faster and keep your best people. Journey makes equity and benefits obvious, so candidates say yes and teams stay — without matching big-tech salaries.

HR & People Teams

Save 10+ hours a week on repeat questions. Auto summaries, targeted nudges, and an admin dashboard keep plans clear and up to date — no PDFs, fewer tickets.

Finance (CFO / FP&A)

Make comp spend work harder. Smarter plan choices and higher 401(k) participation can save ~$2,000 per employee/year, with utilization metrics and exportable ROI reporting.

Employees

Know what you’re getting — and how to grow it. Salary, equity, and benefits explained for your situation, with right-time nudges and one-tap access to a CFP® when decisions matter.